71% OF AMERICANS THINK THE ECONOMY IS RIGGED.

71% of Americans think the economy is rigged. They're Right. Concentration of wealth is killing growth and causing political instability. #itsrigged #turnthedials

Opportunity and economic mobility, hallmarks of the American Dream, are shrinking for the broad majority of Americans.

Our grandparents’ generation had full confidence in the American dream.

This is no longer true. If you were born after 1980 it’s basically the luck of the draw and this trend is only getting worse.

Like an inverted pyramid, our top-heavy economy is unstable.

Standard and Poor’s Rating Agency (S&P) stated clearly that runaway economic inequality is harming U.S. economic growth by excluding large parts of the population from its cumulative benefits. According to their research, higher levels of economic inequality are increasing political pressures, discouraging trade, investment, and hiring.

How do we fix it?

Luckily, Capitalism has dials.

How do we fix it? Luckily, Capitalism has dials.

Dials that can be turned to adjust to various conditions.

Some of these dials include tax policy, monetary policy, trade policy, corporate and financial regulations and investments in public goods like education and infrastructure

"The subjects of every state ought to contribute towards the support of the government, as nearly as possible in proportion to their respective abilities."

The current U.S. tax system follows this principle of PROPORTIONAL CONTRIBUTION, right?

Most people think the system is fair because they only look at personal incomes and Federal income taxes.

This is just a small part of the tax picture.

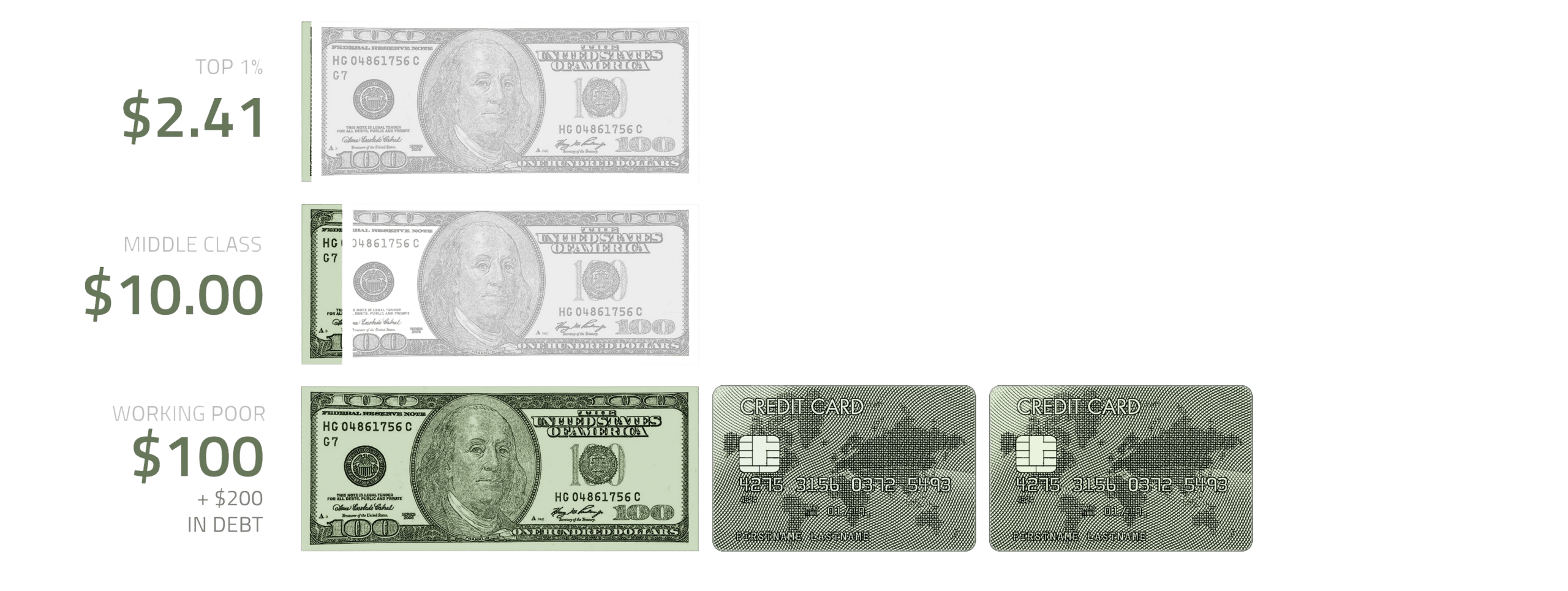

WHEN YOU LOOK AT PERSONAL WEALTH AND ALL TYPES OF TAXES, IT’S CLEAR WHO REALLY PAYS TAXES IN AMERICA.

IT’S NOT THE ELITE.

According to Congress’ own non-partisan research organization, the dials on the current tax system have been turned to take cash from the middle and working classes and distribute it up to the elites. Our tax policy favors elite wealth and punishes the hard work of average Americans.

If the dials have been turned for the elite, we can always turn them back to return OPPORTUNITY and ECONOMIC MOBILITY for EVERY AMERICAN.

LET’S TURN THE DIALS AND RENEW THE AMERICAN DREAM.

The NFL is worth $63 billion, more than any other sports league in the world. In 2016, the value of the average NFL team climbed to $1.97 billion, up 40 percent from the previous year.

What is the key to this growing, successful enterprise?

The dials of the NFL draft are turned to encourage competition: the lowest performing team gets the first round draft pick.

Because the NFL turns the dials to encourage competition, “any given Sunday any team can win.”

Ultimately our team of business and finance leaders know that if we slice the tax pie in a fair manner that increases economic mobility, the entire economic pie grows.

Tax wealth hoarding, not entrepreneurship and work.

Leaders like Presidents Abraham Lincoln and Teddy Roosevelt, in different ways, turned the dials to benefit the middle and working classes of America. They stood up against powerful, elite interests and reformed the American system.

We can do it as well. We can lead again. We can renew the American dream for everyone.

Will you join us?